The adjusted annual salary can be calculated as. PCB calculator Tax calculator EPF Payroll.

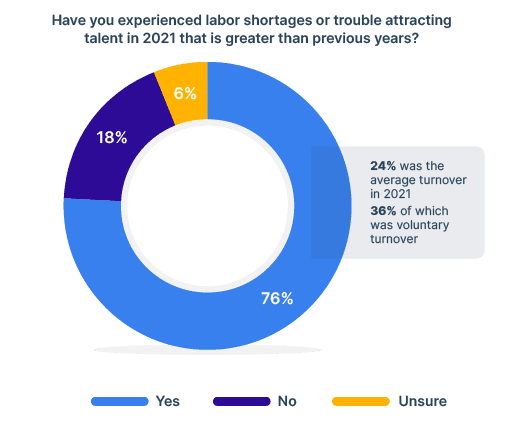

2022 Compensation Best Practices Report Payscale

Please enter a valid email address as you will be sent an email with a calculation.

. This is the amount of salary you are paid. Calculate monthly tax deduction 2022 for Malaysia Tax Residents. For example an employee who works 8 hours a day for a monthly salary of rm260000.

However key talent and returning Malaysians can command premium salaries. Status Status Perkahwinan Tandakan yang berkenaan Individu Kurang Upaya. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for.

RM 201616 - RM 4852276. This is 6 higher RM2804 than the average calculator salary in Malaysia. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and children relief.

Luar Malaysia d Kurang upaya e Kurang upaya belajar di IPT. TALK TO AN EXPERT First Name Last Name Phone Email. Seizing New Opportunities page 4.

Our calculation assumes your salary is the same for and. The Malaysia tax calculator assumes this is your annual salary before tax. For 2021 tax year.

Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Specifically we expect compensation in banking and IT will continue to grow due to increasing regulatory requirements in banking and a skills shortage within IT. Monthly RM Annually RM This salary calculator is applicable for monthly wages up to RM20000 and shows estimates only.

Tax rates range from 0 to 30. It aims to be the minimalist alternative to the Official PCB calculator. About This Malaysian Personal Income Tax Calculator.

Enter Your Salary and the Malaysia Salary Calculator will automatically produce a salary after tax illustration for you simple. Malaysias candidate-short market means certain salaries will rise in 2016 but at a slower rate. 60 Minimum Salary Maximum Salary The salaries provided are for use in the salary comparison.

Fill out the form and click Go to retrieve your results. Calculator Average Base Salary RM50137 MYRyr Average Hourly Rate RM2410 MYR hr Average Bonus RM772 MYR yr Compensation Data Based on Experience The average calculator gross salary in Kuala Lumpur Malaysia is RM50137 or an equivalent hourly rate of RM24. Final Details Estimate your Gross Annual Income.

Taxes for Year of Assessment should be filed by 30 April. Salary for January 2016 RM 1000 x 20 31 RM 64516 The calculations is base on the number of days in a month. You can also divide her biweekly pay by.

Vietnam Salary Guide 2016 report Thailand Salary Guide 2017 report Indonesia Salary Guide 2018 report Categories Business tools tips Human Resources Malaysia Market information data Tags HR job labor report salary. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Salary for january 2016 rm 1000 x 20 31 rm 64516.

If you are looking for salary information on a range of roles click to the next tab For Employers. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Malaysia - Get a free salary comparison based on job title skills experience and education.

Cost of Living Calculator. It is not based on the number of working days in the month. The employees share of the EPF statutory contribution rate was reduced from 11 per cent to 9 per cent in 2021 affecting wages for the months of January to December 2021.

If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Malaysia tax calculator and change the Employment Income and Employment Expenses period. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Income Household 2.

Malaysia Salary Tax Calculator 2022 Fill in the relevant information in the Malaysia salary calculator below and we will prepare a free salary calculation for you including all costs that are incurred. Employer Employee Sub-Total - EPF Contribution. Ordinary Rate Of Pay In This Context Is Basically The Employees Daily Wage And Is Calculated By Dividing The Employees Monthly Salary By 26.

Malaysia Salary Employment Outlook 2017 report summary. When to Use This Calculator Once you know what your total taxable income is You want to work out the tax on that taxable income. Ordinary Rate of Pay OPR.

KWSP dan Kumpulan Wang Lain Yang Diluluskan terhad RM6000 setahun termasuk premium insuranans nyawa. What is Monthly Salary Income Tax Calculator Malaysia. Select Advanced and enter your age to alter age related tax allowances and deductions for your earning in Malaysia.

This personal income tax calculator will work out tax rates obligations and projected tax returns and also tax debts for certain cases. JUMLAH RM Saraan bulan semasa. The employer can use any other formula as he wished as long as the answer he gets is more favourable to the employee than the above answer.

All bi-weekly semi-monthly monthly and quarterly figures are derived from these annual calculations. Taxable Income MYR Tax Rate.

Tax Considerations For Foreign Entities With Or Without Physical Presence In Malaysia Donovan Ho

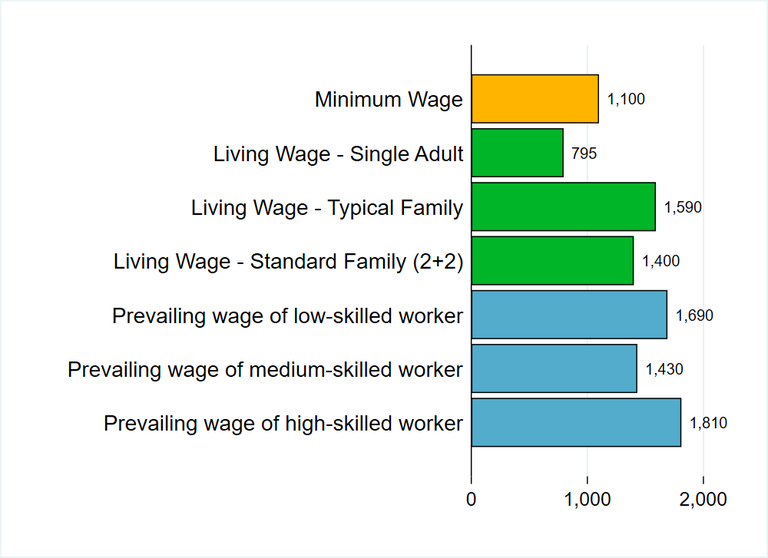

Archive Living Wage Series Malaysia September 2019 In Malaysian Ringgit Per Month Wageindicator Org

How Much Do I Need To Retire In Malaysia At The Age Of 35 Quora

Malaysia Payroll And Tax Activpayroll

Best Practices To Hire Employees In Malaysia Nnroad

Confluence Mobile Community Wiki

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

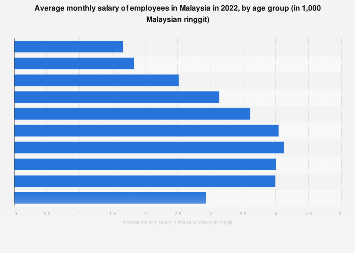

Malaysia Average Salary By Age Statista

Malaysia Inflation Rate Cpi Focuseconomics

Corporate Income Tax In Malaysia Acclime Malaysia

13th Month Pay An Employer S Guide To Monetary Benefits

What Car Can You Really Afford With Rm 5 000 Monthly Salary

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

Malaysia Inflation Rate 2010 2024 Statista

Ibm Predicts Demand For Data Scientists Will Soar 28 By 2020

Malaysia The Pros And Cons Of Living In Malaysia International Living

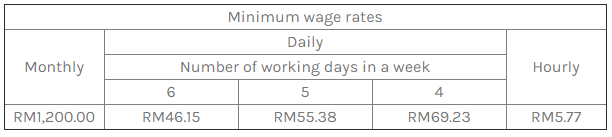

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Employee Payslip Template For Ms Excel Excel Templates Excel Templates Templates Word Template

2022 Compensation Best Practices Report Payscale